The Mid of Week Effect

When you analyse when the profits of stock markets occured you will come to the result that the mid of the week has a stronger tendency to rise than Mondays or Fridays.

Entry:

At the Close of Mondays.

Exit:

At the Close of Thursdays.

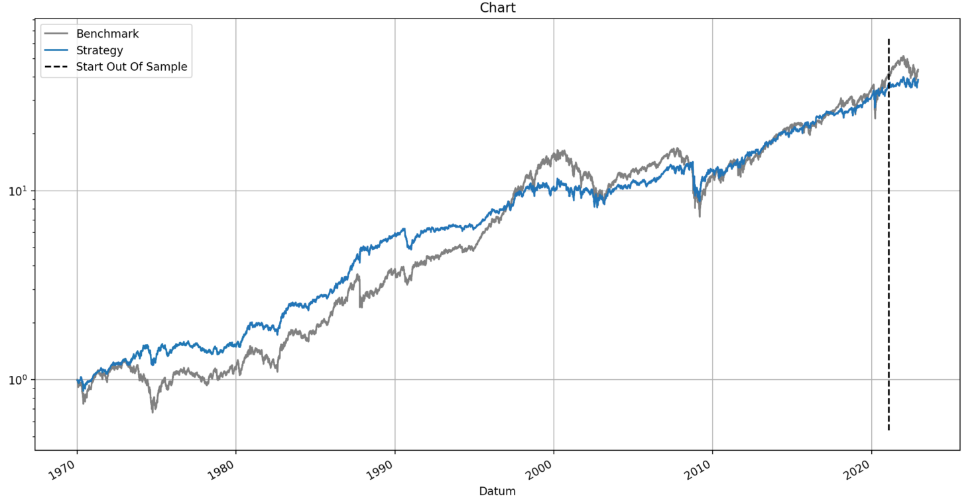

The Equity Curve

Comparing the gray buy and hold curve with the blue strategy curve gets us the result that 99% of all profits where made between Tuesday and Thursday.

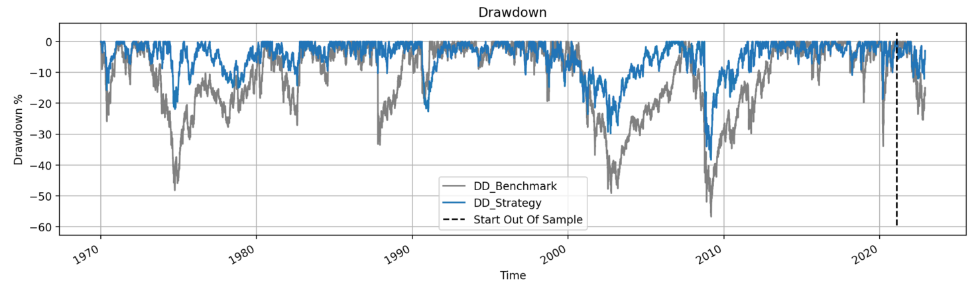

The Drawdown

The graph of the drawdowns show us that the drawdown during the mid of the week were significantly lower than the drawdown of buy and hold. The tendency is strong but we don’t want to trade a strategy with almost 40% drawdown. The system is tradable if we add some more filters which I will maybe show you in another post

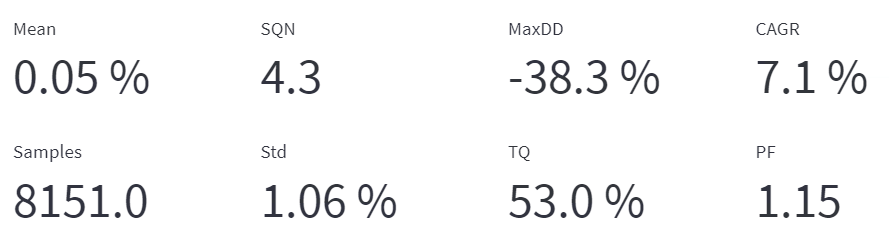

The Metrics

The metrics of the mid of week effet show us a significant outperformance. With a SQN of 4.3 we have a stonger upwards bias than buy and hold. With 7.1% performance per year we almost make as much profits as buy and hold. And we have to keep in mind that we are only invested 60% of the time.